How To Increase Savings For Women

At all-time, information technology is an uneasy human relationship. At its worst, the relationship doesn't exist. It may exist easy to blame years of social workout and patriarchal traditions for the unhappy bond betwixt women and money, but it is fourth dimension women learnt to make peace with it.

Despite the financial pitfalls that a adult female encounters at work and home, gender pay gap, financial illiteracy, familial responsibilities, marital hurdles, legal bias—on her style to monetary empowerment, it is a practiced time to accept charge of her finances. With the easy access to online data, changing social norms, as well equally the liberty to earn and invest, women need to shrug off the taboo and meet the fiscal challenges head on.

At that place is of course, a greater need for a change in piece of work culture and more cooperation from family members. "Both corporates and families need to empower her to ask for her fiscal rights," says Anjali Raghuvanshi, Chief People Officeholder, Randstad India.

Priya Sunder, Director, PeakAlpha Investments agrees. "It is unfortunate that women don't take a greater interest in fiscal dealings or are prevented from doing so by men. They are naturally and favourably predisposed to undertake investing and fiscal planning, which is often amend than men," she says.

To farther encourage women in taking a step toward financial inclusion, we offering solutions to the money problems they confront in various facets of their lives. Exist it single women, married or divorced, at that place are ways to overcome hurdles and go financially independent. In the post-obit pages, we present some of these challenges, exist information technology in dealing with the struggle of saving and investing, tackling financial illiteracy, balancing the needs and wants of parents and children, or overcoming resistance in spousal relationship. We promise y'all will find a way to make your financial dreams come true this Women's Twenty-four hours.

You volition earn less, so salve more

The societal prejudices and biases that confront women at home and piece of work have a way of trickling into their financial lives. "This, despite the fact that women are, by nature, predisposed to amend financial planning for goals," says Priya Sunder, Manager, PeakAlpha Investments.

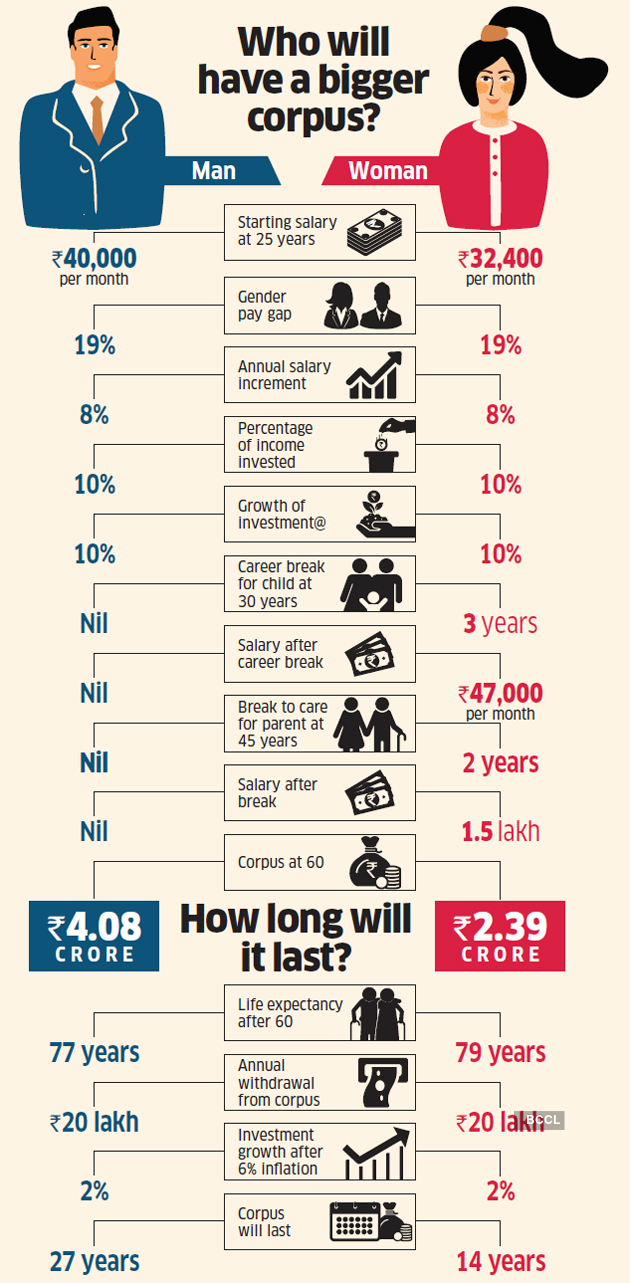

When it comes to single women, be it a mother, divorcee or a widow, information technology is a struggle to manage finances because they are hampered past three hurdles: gender pay gap, caretaking breaks that disrupt their careers, and a longer life bridge, with a life expectancy of 78.half-dozen years at 60, compared with 77.2 years for men. Given that in that location are nearly 74 million single women in India—single, divorced, separated and widowed—equally per the 2022 Demography, it is imperative that they learn how to secure their finances meliorate.

Gender pay gap: According to the Monster Salary Index Report 2022, women in India earn nineteen% less than their male person counterparts, with the median gross hourly salary for men being Rs 242.49 in 2022, compared with women, who earned Rs 196. "At the executive level, the gap is 45%, while it is lesser at 20-35% for entry level," says Anjali Raghuvanshi, Chief People Officer, Randstad India. What this means is that for similar work, skill and feel, a human volition earn more a woman.

Also read: How women tin bridge the large gender pay gap

Career breaks: When it comes to caretaking, be it for children or sick parents, it is women who accept a intermission from their work lives. "This means that not only is there no linear career progression for her, simply she also loses in terms of retirement benefits and forced savings in EPF and VPF," says Sunder. The disruption in salary also means that she stops investing.

Combating hurdles

While societal change and employers initiatives volition have to pay a bigger part in helping reduce the pay gap and adult female's contribution in caretaking, in that location are other ways in which she can be proactive. "While she needs a interruption later on childbirth, it is of import how she uses this intermission," says Raghuvanshi.

Don't stop networking: "She needs to continue to network with colleagues and other people in the industry," says Neeti Sharma, Senior Vice-President, TeamLease Services. If she rejoins afterward 2-3 years, she may non be able to join the same company, so information technology is important to remain connected with people in the same line of piece of work.

Invest in your skills: "Even if she rejoins later on the mandatory six months of maternity leave, she may want a dissimilar work profile," says Raghuvanshi. And so it is important to go on upskilling and updating with the latest developments in the field.

Also read: Women should take this quiz to check their financial literacy

Negotiate ameliorate: "There is nothing wrong in asking for rewards and equal pay if your performance is at par with your male co-workers," says Sharma. So women need to be vocal and confident if they want to close the pay gap.

Strategies to enhance savings

An important factor in how much a woman saves depends on how she invests.

Speed upward saving: Since the woman will end up saving less due to the gender pay gap and fewer years she puts in at work, i way of overcoming this hurdle is by increasing her monthly savings. Then if a 25-year-erstwhile woman is building a corpus for retirement at lx, she will accept to save nearly 17% of her income compared with 10% that men would have to in order to build the aforementioned corpus. If she finds information technology hard to practise then, she can automate her investments or increase her EPF and VPF contribution with her employer, and then that the money is saved before she can spend it.

Optimise investments: Though at that place is no deviation in the style a woman or man invests, the all-time fashion to brand upwards for lost time and money is to invest smarter. For all the long-term goals, be information technology retirement or her children's education and wedding ceremony, which are more than 12-13 years away, she should harness the growth of equity, which gives one of the highest returns in all asset classes. A small portion, nonetheless, needs to exist kept in debt for safety. She should as well factor in the eroding effect of inflation and taxation while making calculations as these eat into the corpus.

Protect investments: To ensure that her life and investments are gratuitous of risk, information technology is crucial to keep an emergency corpus and purchase the right insurance. If she is single, she should stock up at least eight months of household expenses as contingency. To protect her children, buying term life insurance, which is 7-x times her almanac income, is of import. To avoid medical costs eating into her retirement corpus, she should as well buy wellness insurance for herself and her children.

Piece of work longer: Another style to enhance earning power and compensating for lost money is that the woman skill herself in a fashion that she continues to piece of work even after retirement.

Strategies for 'sandwich' moms

Despite being consummate jugglers, women may non always savour existence a 'sandwich', caught betwixt the financial needs of their parents and children. While it'southward not easy balancing a finite income with infinite financial responsibilities, prioritising needs and optimising investments can help. Before focusing on parents and kids, it is important to secure your own finances because only if yous are financially strong will you exist able to assistance them.

Also read: How a married woman can protect her financial rights

Secure yourself first

Salvage for retirement: From the day you offset earning, invest for your retirement by putting your money in a mix of equity funds and debt instruments. If y'all are in your 30s, put at to the lowest degree lxx% of your savings in equity and xxx% in debt. The former can exist in the course of equity funds and the latter can comprise EPF, VPF, PPF and NPS. Remember that kids tin can take loans and parents volition take assets that tin can be monetised, merely you volition have no source of funding your retirement.

Emergency corpus: With dependants, you lot cannot afford to see a fiscal crisis, say, chore loss or medical trouble. Then even before you start investing, build a contingency corpus equal to four-6 months of household expenses.

Buy insurance: Another tool to secure your family unit is to purchase term life insurance that is 7-x times your almanac income, keeping in mind the number of dependants and loans. For health, selection a Rs 5-ten lakh family floater plan for your spouse and kids, merely purchase a separate plan for your parents. Also have a Rs 25-30 lakh critical illness plan for yourself and your spouse.

Optimise investment for parents, children

Parents: Generate income stream

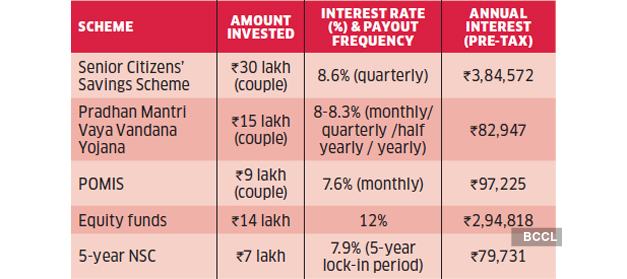

Instead of investing your parents' savings only in debt instruments, include a 20% equity component. If you invest Rs 75 lakh for x years, here's how equity will help generate a bigger income for them.

They volition earn: The above investments will help create a pre-tax monthly income of Rs 78,274. If, on the other hand, you lot invest Rs xxx lakh in SCSS and Rs 45 lakh in fixed deposits at 7.5% for x years, you will assist create a monthly income of Rs 67,415, a difference of Rs ten,859.

Investing strategy for all

For parents-

Equity: xx%

Debt: 30%

Cash: 50%

For prophylactic of upper-case letter, most assets should be in debt, but a part should also be in equity to aid the corpus grow. Greenbacks is besides a must for emergencies.

For self-

Disinterestedness: 65%

Debt: 25%

Cash: 10%

Invest at to the lowest degree 65% in equity since information technology gives good returns over the long term, and your goals have a long horizon.

For kids-

Equity: ninety%

Debt: v%

Greenbacks: 5%

Since the goals are longterm and there are no immediate demands on money, debt and greenbacks should be negligible.

Monetise your parents' assets

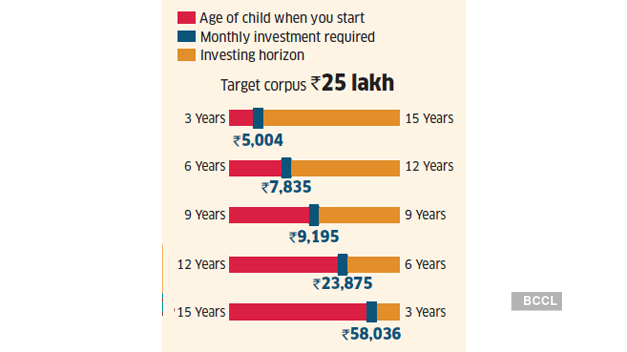

Kids: Start early on, invest less

If you need Rs 25 lakh for your child'south education goal when he turns 18, here'southward the monthly investment required @12% depending on when you lot outset investing.

How to aid parents

If your parents do not take a skillful cash flow and income stream, it's likely that you will end upwardly supporting them and compromising your own goals or scaling down your own lifestyle. To avoid doing so, hither's what y'all need to practise.

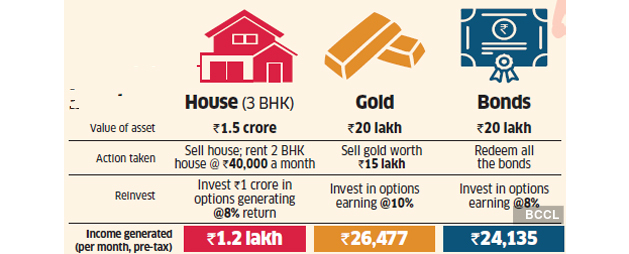

Invest and monetise: "It is rare that parents don't have money. It'southward just that it is illiquid, and in the form of property or gold," says Sunder. "Then the first stride is to monetise these assets," she adds. This may crave a change of mindset for a generation that placed their faith in debt investments with low returns and property. Information technology will, however, offer financial independence to your parents and reduce your brunt. Y'all should too help invest their retirement benefits in debt instruments, with 15-twenty% equity component to assistance their money abound.

Health needs: "If you are working, embrace your parents in the company policy because your spouse can be covered by his employer," says Sunder. If you lot are not employed, depending on the amount you tin spare, purchase a small base encompass of, say, Rs 3 lakh, for the parents and a higher topup plan of Rs 15 lakh with a Rs 3 lakh deductible.

Children'due south needs

Saving for kids' goals: Start saving for the kids' instruction the moment the kid is built-in. Since it is a long-term goal, invest in equity funds via systematic investment plans (SIPs), which will give good returns in 15-xvi years. Increase the investment with the rise in income to speed up the procedure of reaching the goal.

Education loans and weddings: With soaring education aggrandizement and the pressure level of saving for their own retirement, parents no longer have the luxury of funding both the educational activity and weddings of their children. "Right now wedding is non a goal for us and we are focusing only on educating our child," says Mira Narayan, a 35-year-old marketing manager in Bombay. "If at the time of wedding, we are in a position to contribute, nosotros volition," she adds. Education loans too are an piece of cake style to reduce your own financial brunt and teach the child fiscal subject area and responsibility.

How To Increase Savings For Women,

Source: https://economictimes.indiatimes.com/wealth/plan/women-need-to-save-more-as-they-earn-less-live-longer-than-men-heres-how-to-do-it/articleshow/74415376.cms

Posted by: blackstockwhippyraton62.blogspot.com

0 Response to "How To Increase Savings For Women"

Post a Comment